You may be liable to tax on your previously exempted investment income effective from 2 January 2022 - Tax & Business Matters - Nigeria

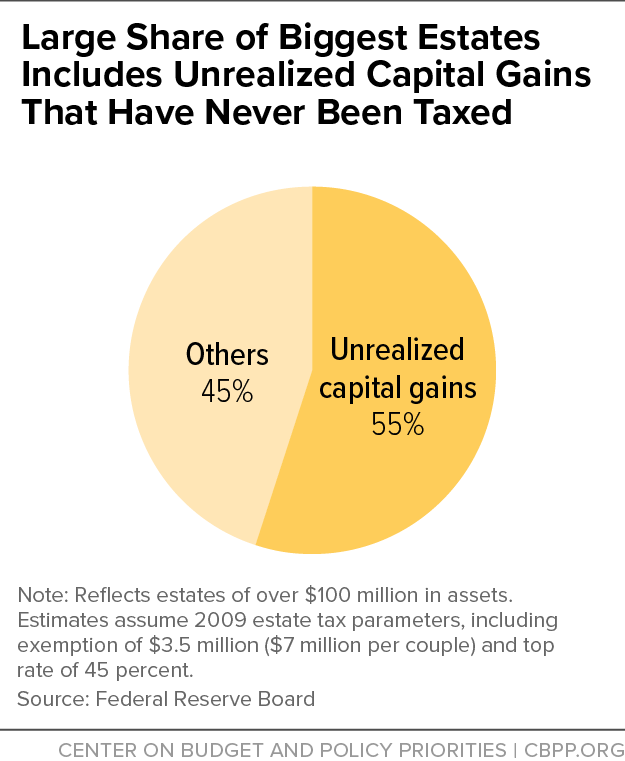

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

Federal Inland Revenue Service NG on Twitter: "30th JUNE, 2018 is the DUE DATE for filing the following tax returns: For companies having 31st December, 2017 as Accounting Year End 1) Company

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

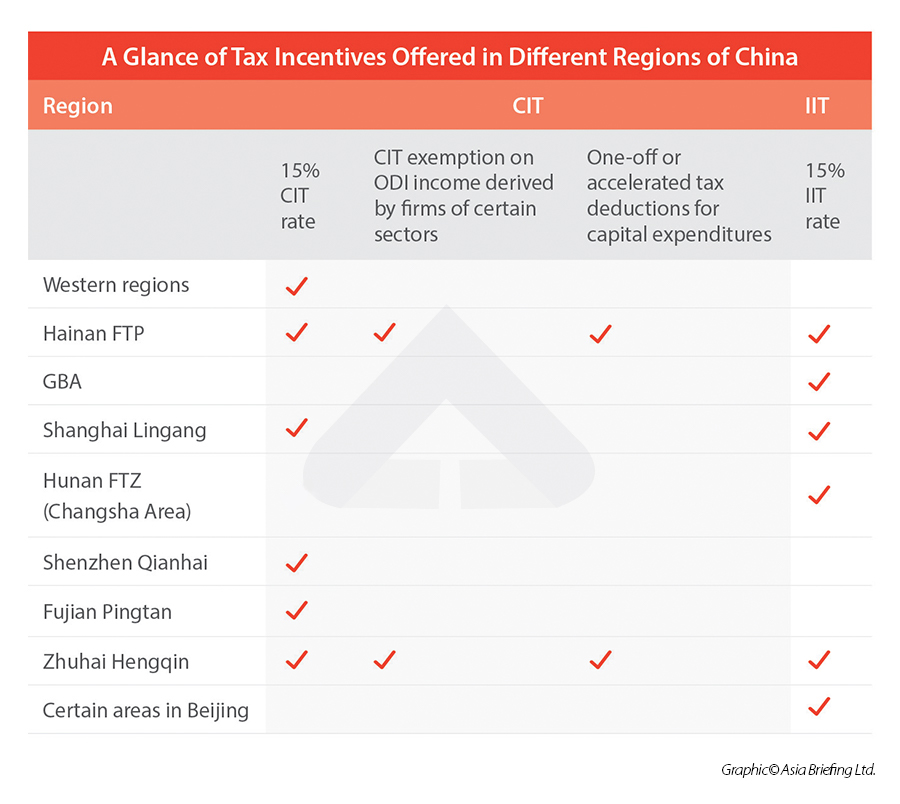

What is the Difference between the Current Corporate Income Tax and a Destination-Based Cash Flow Tax?

Capital Income Tax - TAX Questions and answers... 909-574-1737 QUESTION: Can you process my taxes even though I live in Florida, North Dakota, Utah, Nevada, Wyoming, Indiana, Texas, Michigan, Missouri, Georgia, Oregon,